|

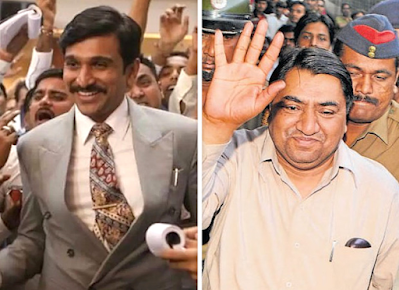

| Image Courtesy: Bollywood Hungama |

The irregularities in securities transactions of the banks and financial companies known as securities scam, which came to light in the second quarter of 1992 is unprecedented in many respects.

Both the volume and the involvement of individuals and the institutions were various and stupendous. It embraces among others foreign banks, financial and other public/private sector corporations, the principal stock exchanges, select brokers, and persons occupying high offices.

The Web-Series:

The securities scandal of 1992, with Harshad Mehta as its main player, is back in collective consciousness nearly three decades after it was perpetrated, thanks to Sony LIV's popular web series Scam 1992.

While the series has been praised for its largely accurate portrayal of the events that transpired - down to a fleeting mention of the fiscal deficit in the Budget 1986 speech, as is shown when a character is watching it on TV - there are only so many details that it can capture given the scope of the medium.

The Actual Scam:

The scam was the biggest money market scam ever committed in India, amounting to approx. Rs. 5000 crore. It was a systematic stock fraud using bank receipts and stamp paper which caused the Indian stock market to crash after it was saved by him from bankruptcy of India.

The scam exposed the inherent loopholes of the Indian financial systems and resulted in a completely reformed system of stock transactions, including an introduction of online security systems.

But the central figure of the scam remains Harshad, and the 1992 securities scam is often referred to as the Harshad Mehta scam, which would be either giving him too much credit, or making him the scapegoat, depending on how you look at it.

What does People Feel of Harshad?

So what does one make of Harshad? Was he a skilled stock picker, or just a clever salesman who was able to sell tall stories, or a hustler adept at exploiting the cracks in the system or a convenient fall guy for those at the highest levels of power?

A fair answer would be that he was a little of everything but by no means a Superman who could move India’s stock market at will.

Like stock market operators before him and after him, he only controlled a handful of stocks—but stocks important enough to influence the direction of the index and thereby the mood in the market.

Harshad managed to convince financial institutions to buy the stocks he was bullish on.

He may have had some good ideas, but it can’t be denied that the institutions’ support for Harshad also had to do with his clout in the corridors of power in Delhi and the quest for quick profits, rather than their belief in his stock-picking skills.

Harshad managed to divert large sums from the banking system to the stock market, by exploiting the loopholes in the system. But foreign banks and their chosen brokers too had been toying with the system much before Harshad stumbled into the loopholes.

RBI was aware but given India’s precarious forex reserves position and the periodic dependence on foreign banks chose to turn a blind eye.

Impact of Scam 1992:

The immediate impact was a drastic fall in share prices and market index, causing a breakdown of the securities control system operation with the commercial banks and the RBI. Around ₹35 billion from the ₹2,500 billion market was withdrawn, causing the share market collapse.

The Bombay Stock shares resorted to records tampering in the trading system. It caused panic with the public and banks were severely impacted. Banks like Standard Chartered and ANZ Grindlays were implicated in the scam for bank receipt forgery and transfer of money into Mehta's personal account.

The government realized that the fundamental problem with the financial structure of the stock markets was the lack of computerized systems which impacted the whole stock market.

Various bank officers were investigated and implicated in fraudulent charges. The five main accused officials were related to the Financial Fairgrowth Services Limited (FFSL) and Andhra Bank Financial Services Ltd (ABFSL).

The chairman of Vijaya Bank committed suicide following the news about the bank receipt scam. The scam led to the resignation of P. Chidambaram who was accused of owning shell companies connected to Mehta.

Mehta was convicted by the Bombay High Court and the Supreme Court of India for his part in the financial scandal valued at ₹49.99 billion (USD $740 million). Various bank officials were arrested, leading to a complete breakdown of banking systems.

Written by: Gopal Prasad

Edited by: Gourav Chowdhury

.JPG)

.jpeg)

0 Comments